Why the Best Investors Aren’t Trying to Predict the Market

Paul Barreca - Jan 08, 2026

Every year, a familiar ritual plays out.

Banks, investment firms, and market “experts” release their predictions for where the stock market will be by the end of the year.

And every year, many investors feel tempted to act on those forecasts.

Here’s the problem: Stock market predictions have a terrible track record.

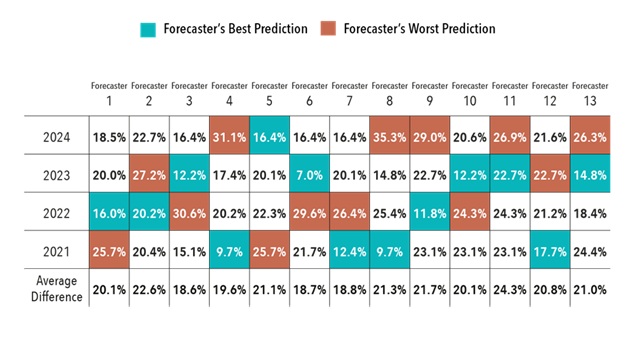

Bloomberg tracks year-end stock market predictions from professional equity analysts and compares them to what actually happened.

The results are eye-opening.

Over the past several years:

- Even the most accurate forecaster was off by an average of 18.6%

- Many individual predictions missed the mark by more than 20%

Absolute Difference Between Equity Analyst Forecasts and Actual S&P Index Calendar-Year Price Returns

i

This is not about making fun of analysts. Many are smart and well informed. It is about recognizing how hard this task really is.

The real risk is not that forecasts are wrong.

The real risk is what investors do because of them.

When people believe predictions:

- They delay investing while waiting for a better time

- They sell after bad news and miss recoveries

- They chase performance after markets already rise

- They change long-term plans based on short-term guesses

These decisions feel rational in the moment. In hindsight, they often hurt results.

You do not need to predict the stock market to be a successful investor.

Instead, focus on what you can control:

- Your savings rate

- Your diversification

- Your time horizon

- Your behavior during market ups and downs

Markets will always be unpredictable. That is not a flaw. It is the price investors pay for long-term growth.

Forecasts can be entertaining and drive clicks for news organizations.

Just do not confuse them with reliable guidance.

You do not have to play that game.