Is It Different This Time?

William Barreca - Apr 23, 2025

Every financial crisis feels unprecedented in the moment.

Today, it’s trade wars and tariffs.

People always say, “It’s different this time,” and they're absolutely right.

“History doesn’t repeat itself, but it often rhymes.”

Every market crisis is unique in its causes and circumstances.

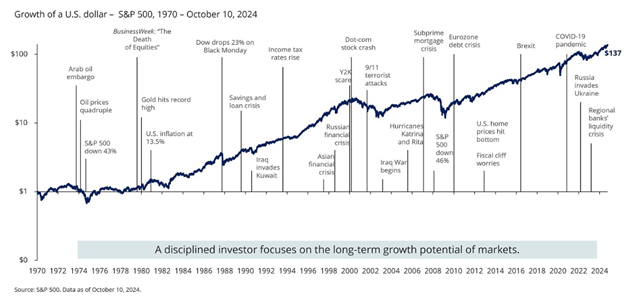

Let's revisit some significant market crises. How did the stock market respond? And what can we learn that might guide us today:

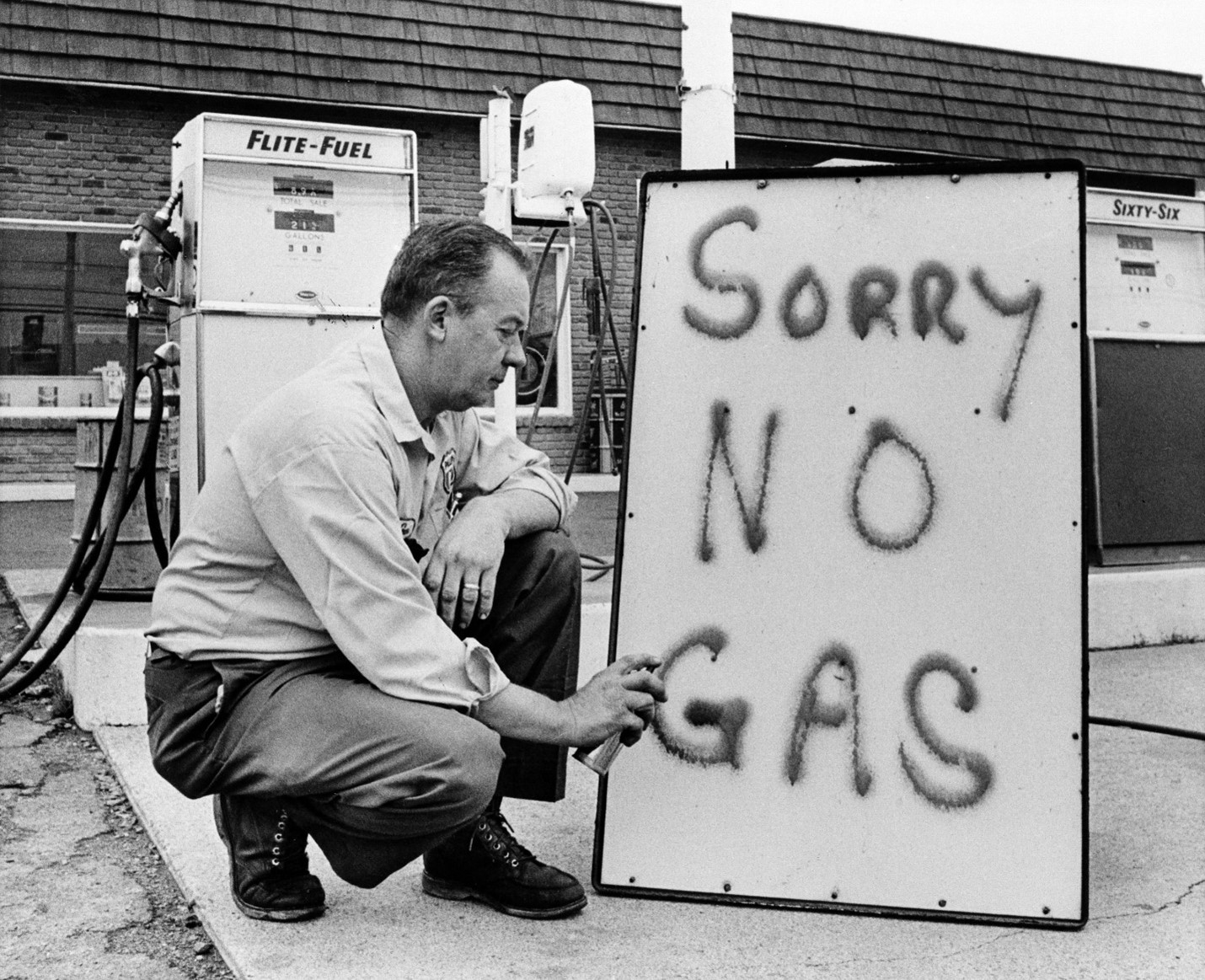

The 1973 Oil Crisis:

The 1973 oil crisis began when the Organization of Arab Petroleum Exporting Countries (OAPEC) proclaimed an oil embargo.

Consumers faced gasoline shortages, long lines at fuel stations, and widespread anxiety. Investors panicked, resulting in the S&P 500 falling approximately 48% from its high. The bear market lasted about 21 months.

By 1976, stocks had fully recovered.

Black Monday (1987):

On October 19, 1987, now known as Black Monday, the stock market dropped by 22.6% in one day.

This unprecedented drop was driven largely by automated trading programs triggering widespread panic. Many investors thought the system itself had broken. Yet, within two years, the market had fully recovered, and by the early 1990s, stocks reached new highs, ushering in a decade-long bull market.

9/11 (2001):

Following the September 11 terrorist attacks, global markets shut down temporarily. Upon reopening, panic selling caused the S&P 500 to drop over 14% within one week. However, within two months, markets regained these losses.

Global Financial Crisis (2007–2009):

A housing market crash triggered massive bank failures, severe recession, and widespread economic distress. At its worst, the S&P 500 lost roughly 57%.

By March 2009, the market had bottomed out and began a massive recovery.

European Debt Crisis (2010–2012):

Between 2010 and 2012, fears of sovereign debt defaults in Greece, Portugal, Italy, Ireland, and Spain created significant global market volatility. The S&P 500 experienced a drop of about 19% in 2011. Despite constant predictions of economic collapse, coordinated global action and intervention stabilized markets. By early 2013, markets reached new highs.

Brexit (2016):

In June 2016, Britain's unexpected vote to exit the European Union stunned global markets, causing an immediate and sharp decline of more than 5% in the S&P 500 within days. However, within two weeks the markets bounced back quickly as investors digested the news and recognized that Brexit was not an existential threat to global growth.

COVID-19 Pandemic (2020):

In March 2020, COVID-19 rapidly triggered economic shutdowns globally, causing the fastest bear market in history. Within a month, the S&P 500 dropped about 34%.

By August 2020, just five months after the low, markets had fully rebounded, and by year-end, the S&P 500 was hitting record highs again.

I only named 7, but you can look back in history and find different examples almost every year.

And when you zoom out, they all look like a blip.

We can’t control any of this. We also can’t predict when they will happen.

What’s inevitable is that you will experience multiple events like this over your investing lifetime. And you must be prepared for them whenever they happen.

You should have a plan that you can stick with during the inevitable market downturns, and that will also provide enough of a return that will allow you to reach your goals.

If you don’t have that already, take this as an opportunity to assess what needs to change.

*The views and opinions expressed in this article may not necessarily reflect those of IPC Securities Corporation.