Warren Buffett, the legendary investor and Chairman of Berkshire Hathaway, has once again provided invaluable insights for investors in his latest shareholders letter. Buffett's wisdom transcends mere financial advice; it's a masterclass in long-term thinking and disciplined investing. Let's delve into some key takeaways from his latest letter and lessons you can use to make yourself a better investor.

1. Ignore short-term market movement

"It is more than silly, however, to make judgments about Berkshire's investment value based on "earnings" that incorporate the capricious day-by-day and, yes, even year-by-year movements of the stock market. As Ben Graham taught me, "In the short run the market acts as a voting machine; in the long run it becomes a weighing machine."

The stock market moves up and down. Often, with no discernable reason. What happened in the stock market yesterday, last week, or even last year should not change your long-term investment strategy.

Studies have shown that investors who frequently check their investments perform worse than those who rarely look at theirs. In his research paper, Professor John List found that, "professional traders who receive infrequent price information invest 33% more in risky assets, yielding profits that are 53% higher, compared with traders who receive frequent price information."

2. Picking stocks is hard and most people can't do it successfully

"Within capitalism, some businesses will flourish for a very long time while others will prove to be sinkholes. It's harder than you would think to predict which will be the winners and losers. And those who tell you they know the answer are usually either self-delusional or snake-oil salesmen." Picking individual stocks seems easy. But if you dig below the surface, it's incredibly difficult to do successfully.

Whether it's Blockbuster, Sears, BlackBerry or Kodak, history is littered with once seemingly invincible companies that no longer exist or are greatly diminished today.

Even if you can identify a great company, you also have to be able to value it correctly. For example, if you'd bought Microsoft stock at the peak of the tech bubble in 2000, it would've taken you 14 years to break even. Microsoft didn't stop being a great company during those 14 years, but the price you pay matters.

The industry is filled with claims of "star" fund managers and financial advisors who market themselves as great stock pickers. View these individuals with great skepticism.

3. Investing is different than gambling

"Though the stock market is massively larger than it was in our early years, today's active participants are neither more emotionally stable nor better taught than when I was in school. For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young. The casino now resides in many homes and daily tempts the occupants. One fact of financial life should never be forgotten. Wall Street – to use the term in its figurative sense – would like its customers to make money, but what truly causes its denizens' juices to flow is feverish activity. At such times, whatever foolishness can be marketed will be vigorously marketed – not by everyone but always by someone."

For me, a regretful development in the investment industry has been the conflation of gambling with investing. This is not an entirely new development and has always existed, but I sense that it's gotten worse.

Whether it's different cryptocurrencies, GameStop, or speculative technology companies, there are endless examples of gambling being mistakenly referred to as "investing".

This has, in part, been fueled by the popularization of internet trading platforms, which offer low-cost, and in some cases, free trading of stocks.

For the right person, and when used properly, these platforms can be useful, but they also encourage bad behavior like gambling and short-term trading.

It's also important to remember that nothing in life is free. If you don't pay for the product, then you become the product.

4. A focus on dividends is misplaced

"Berkshire does not currently pay dividends."

Dividends are one of the most misunderstood parts of investing. A dividend is not free money that a business is somehow able to conjure out of thin air and pay to its investors.

Very simply, a dividend is a payment of part of the business's cash flows back to its shareholders. The company's value also declines by the amount of dividends it pays out.

Other options businesses can use for that cash include buying back its shares, which increases the percentage of ownership for its remaining shareholders.

Cash can also be used to reinvest in the business and theoretically increase future shareholder value.

The optimal use of cash flow differs from company to company. Sometimes, it's one or the other. Sometimes, it's a mixture of all three.

The point is that a singular focus on dividends is misplaced and not an optimal way to invest.

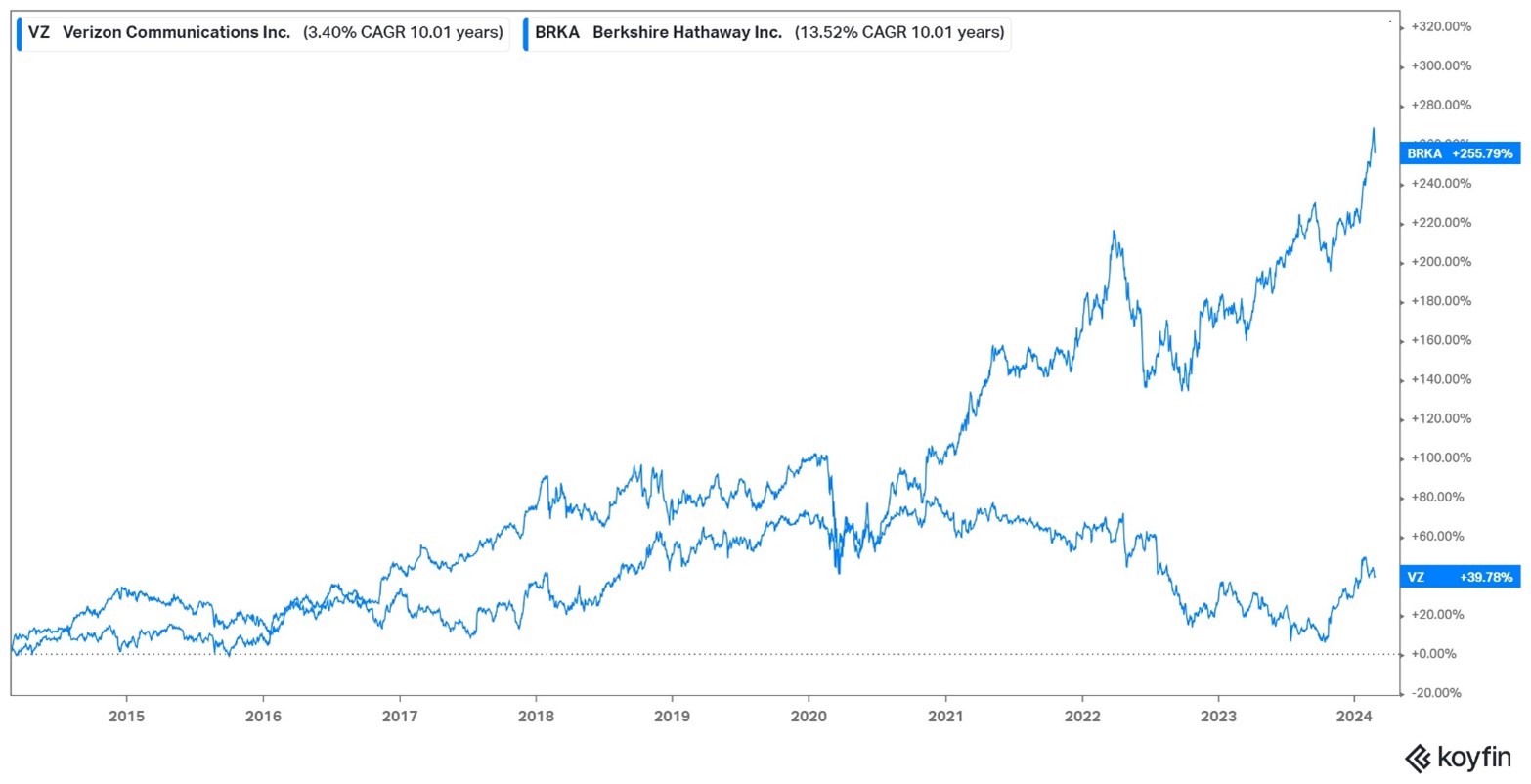

To illustrate, compare the non-dividend payer Berkshire Hathaway to Verizon, which is currently paying a dividend of over 6%.

*The views and opinions expressed in this article may not necessarily reflect those of IPC Securities Corporation.

iHaigh, Michael S., and John A. List. “Do Professional Traders Exhibit Myopic Loss Aversion? An Experimental Analysis.” The Journal of Finance, vol. 60, no. 1, 2005, pp. 523–34. JSTOR, http://www.jstor.org/stable/3694846. Accessed 27 Feb. 2024.