Equity compensation, often referred to as stock-based compensation, involves offering employees a share in the ownership of the company. This can take various forms, including:

Stock Options: Stock options give employees the right to purchase company shares at a predetermined price, known as the "strike" or "exercise" price. These options often come with a vesting period, during which the employee needs to remain with the company before exercising the options.

Restricted Stock Units (RSUs): RSUs grant employees a promise of a certain number of company shares at a future date. Unlike stock options, employees do not need to purchase these shares; they are awarded them outright after a vesting period.

Employee Stock Purchase Plans (ESPPs): ESPPs allow employees to purchase company shares at a discounted price. These plans are often offered as a benefit to all employees and can provide a cost-effective way to invest in the company. Alternatively, the ESPP might incentivize your participation in the plan through an employer match, where your company will match a certain portion of your contributions to purchase shares.

Tax Implications

In Canada, the tax treatment varies based on the type of equity compensation:

Stock Options: When stock options are exercised, the difference between the exercise price and the fair market value of the shares is considered a taxable employment benefit. This benefit is subject to income tax and is reported on the employee's T4 slip.

RSUs: For RSUs, the value of the vested shares is considered employment income when they are transferred to the employee. This amount is also subject to income tax.

ESPPs: The discount received by employees when purchasing shares through an ESPP is generally considered a taxable benefit and is subject to income tax.

Considerations for Employees

Before implementing or accepting equity compensation, there are important factors to consider:

Vesting Periods: Understand the vesting schedule associated with the equity grants. This affects when and how much ownership an employee gains.

Tax Planning: Both employers and employees should consult tax professionals to understand the tax implications and explore strategies to optimize tax outcomes.

Diversification: Employees need to strike a balance between their investments in the company and other diversified assets to mitigate risk.

Diversification is by far the biggest issue I encounter with equity compensation.

Whether it’s because of emotional attachment to a company or procrastination people often just continue to let their holding of their company stock continue to grow over the years.

Gradually, an outsized portion of their net-worth & retirement savings becomes tied to the fate of one company. This is in addition to the fact that this is the same company that writes their paycheques.

Having such a large part of your financial future tied to the fate of one company creates lots of risk.

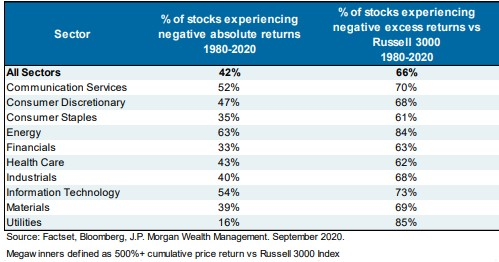

J.P. Morgan Wealth Management conducted a study showing that between 1980-2020, 66% of companies in the Russell 3000 Index underperformed the Index.

The study also found that 42% of companies in the Russell 3000 actually experienced negative returns.1

Based on this, all things being equal, there’s a good chance your companies stock will underperform a diversified index.

Worst case scenario, your company could go the way of Kodak, Enron, Blackberry, Sears etc. Companies that at one point seemed rock solid, and now either don’t exist or are worth a fraction of their previous value.

*The views and opinions expressed in this article may not necessarily reflect those of IPC Securities Corporation.